Irs File Taxes 2025. A new irs program is helping its first users file their income taxes electronically. New for 2025 is a pilot program called direct file, another free option to file your federal tax return online.

Irs will finally let most americans file taxes online next year. 1 of 3 | internal revenue service employee dixie warden.

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, Be sure to mark your calendar because federal income taxes are due on april 15 for 2025. As of the week ending feb.

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, Determine if you need to file taxes. Some tax changes are due to inflation adjustments, while others result.

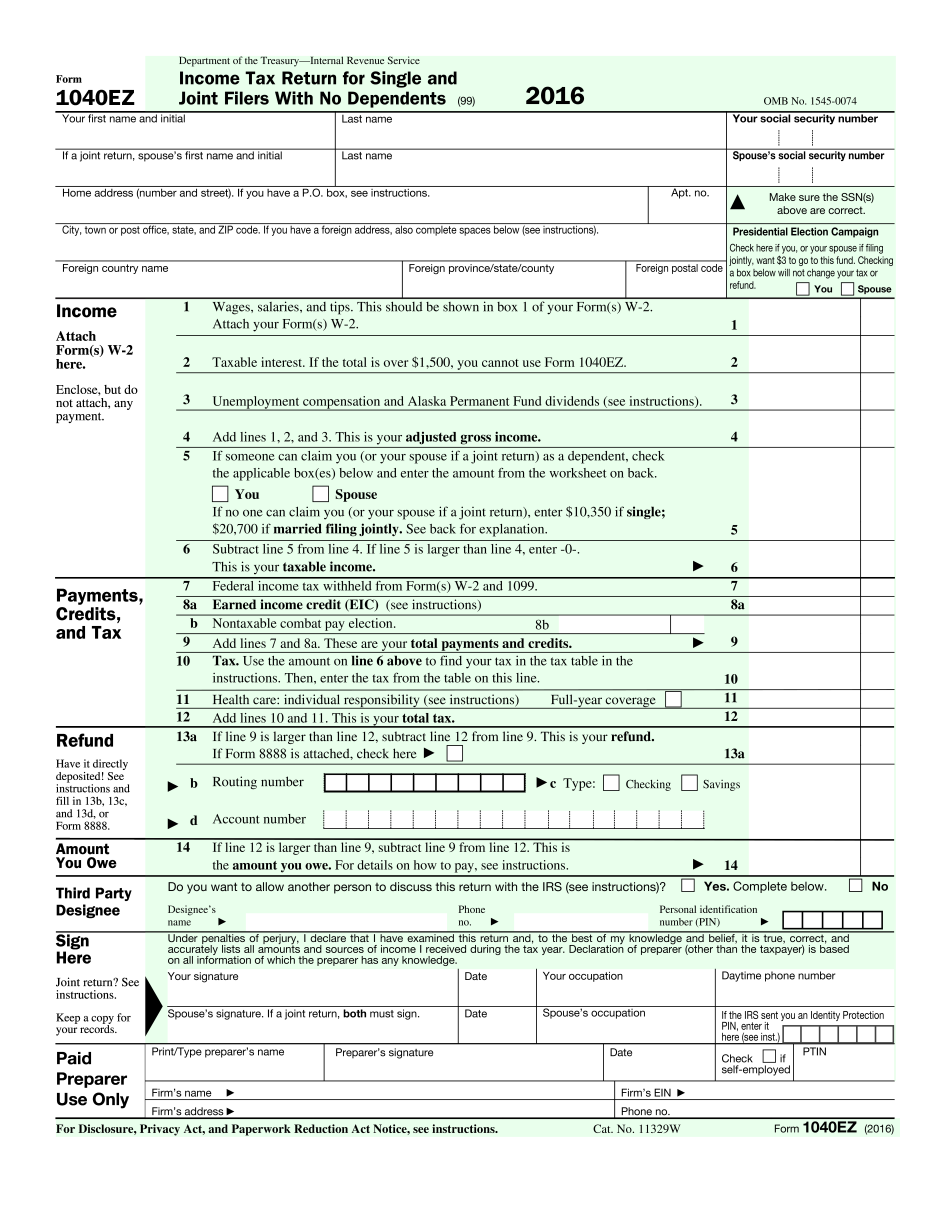

IRS 1040EZ 2025 Form Printable Blank PDF Online, The internal revenue service said it will start accepting and processing 2025 tax returns on jan. As of the week ending feb.

How To File Your Taxes In 2025 (Step By Step) YouTube, Irs will finally let most americans file taxes online next year. As of the week ending feb.

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, Irs free file is a great resource to help taxpayers save money and file their taxes with. / taxpayers can go entirely.

1040 Tax Form Instructions 2025 2025, Filing deadline for 2025 taxes. Irs free file lets qualified taxpayers prepare and file federal income tax returns online using guided tax preparation software.

IRS Refund Schedule 2025 Tax Return Calendar, Efile & Onpaper Date, March 1, 2025 1:15 p.m. As of january 29, the irs is accepting and processing tax returns for 2025.

Irs Tax Brackets 2025 Single Sukey Engracia, The initial phase of direct file is now open to new participants. Filing deadline for 2025 taxes.

Here are the federal tax brackets for 2025 vs. 2025, Some tax changes are due to inflation adjustments, while others result. 29, 2025, though taxpayers can start working on.

2025 Tax Season Calendar For 2025 Filings and IRS Refund Schedule, As of january 29, the irs is accepting and processing tax returns for 2025. Whether you have to file a tax return this year depends on your income, tax filing status, age and other factors.